Account: Definition | Explanation | Examples | Types | Classification | Meaning | What Is

What do YOU think of when you hear the word “account”?

Here’s what the term account means in general business – as well as in the specific context of accounting.

= Buyer–an individual or an entity–with an outstanding accounts receivable balance with a seller.

Example:

Client sales accounts that represent the customers of an advertising, consulting, accounting or any other services firm.

= Future payment transactions, where sales are not made in exchange for immediate cash consideration but “on credit” or “on account”

Example:

Contractual relationship where a buyer pays a seller for goods and services received at a later date, based on the credit payment terms associated with the transaction, typically in 30-90 days, called “Net-30/60/90”)

= Statement of requirements or transactions arising out of a contract or a fiduciary relationship.

Example:

Escrow accounts held by attorneys or accounts held by executors to record transactions in administering an estate.

= Country’s record of financial transactions made between individuals, businesses and its government with foreign consumers and organisations.

Example:

Balance of payments of a country split into three parts:

This is the most obvious example that we come across every day.

= Accounts individuals and businesses hold with banks and financial services firms to process deposits and borrowings.

Example:

Checking, savings, loan and mortgage accounts

Of course, these are all valid uses of the term account.

BUT: When we’re talking about an account in the context of accounting, the word gets a completely different meaning.

An account can have several meanings in the accounting profession.

The top 5 are as follows:

Let’s take a look at each of these common account use cases in more detail:

Every day, many different transactions happen in a business. For instance, goods/services are sold to customers, purchases are made from suppliers, cash is paid to creditors and received from debtors.

All of these transactions must be properly recorded and analyzed.

That is where the accounting comes in–and the extensive use of accounts with it.

Accounting

This is the sequence of steps in the accounting function:

Step 1

Day Books

Transactions are recorded in ‘books of prime entry’, also known as ‘day books’.

Step 2

General Ledger

On a regular basis (e.g., daily or weekly, depending on transaction volume), the day books are totalled and posted to general ledger accounts.

Step 3

Financial Statements

At the end of an accounting period, a balance is calculated on each ledger account and used to create the financial statements.

Step 4

Other Reports

Transactions are analyzed and summarised in a variety of financial, management and other reports for internal and external use.

This table clarifies the difference between financial accounts (more often called financial statements) and management accounts:

Here is the main difference between financial statements and management accounts:

| Financial vs. Management Accounts | Financial Accounts | Management Accounts |

|---|---|---|

| Definition | Financial statements are produced by most businesses each year for external use and to comply with statutory regulations. | Management accounts and reports are produced for internal purposes to aid management in planning, control and decision-making. |

| Examples | • Statement of Profit or Loss (also ‘Profit and Loss Account’ or ‘Income Statement’) | • Budgets and forecasts |

| • Statement of Financial Position (formerly Balance Sheet) | • KPI reports (key performance indicators) | |

| • Statement of Cash Flows (formerly Cash Flow Statement) | • Investment appraisals |

A business should produce financial information about its activities because there are various groups of people who want or need to know that information, including:

Who does all the work to produce all of these financial, management and other accounts for internal and external use? Accountants!

Accountant

Keep reading to find out how exactly do accountants get the job of accounting done through different types of accounts >>

Account in Accounting

The general ledger is a collection of all of company’s accounts where all the double entries for all transactions of the business are recorded, collected, stored and sorted.

Ledger account is an individual record that categorizes and summarizes similar transactions for each type of asset/liability, income/expense or capital maintained within the ledger of a business.

For example:

General leger is used to prepare the financial statements (e.g., balance sheet, income statement, statement of cash flows) at the end of an accounting period, as well as management and other reports and analyses.

A chart of accounts is a full list of all accounts and their number used for recording transactions in a general ledger of a particular entity that are set up in its accounting system.

Current Assets (Account #10000 – 14999)

10100 Petty Cash

10200 Cash

11100 Accounts Receivable

12100 Bad Debt Allowance

13100 Inventory

14500 Prepayments

Non-current Assets (Account #15000 – 19999)

15000 Land

16100 Buildings

16200 Equipment

16300 Vehicles

17100 Intellectual Property

18100 Depreciation

19100 Amortization

Short-term Liabilities (Account #20000 – 24999)

20100 Accounts Payable

21000 Interest Payable

22100 Salaries Payable

22200 Wages Payable

23100 Unearned Revenue

Long-term Liabilities (Account #25000 – 29999)

25100 Loans Payable

25900 Securities Payable

Equity (Account #30000 – 39999)

30000 Retained Earnings

35000 Common Stock

39000 Treasury Stock

Sales Revenues (account #40000 – 49999)

40101 Sales – Division #1, Product Line #1

40205 Sales – Division #2, Product Line #5

40533 Sales – Division #5, Product Line #33

Cost of Goods Sold (account #50000 – 59999)

51203 COGS – Division #12, Product Line #3

51188 COGS – Division #11, Product Line #88

Expenses (Account #60000 – 60999)

60010 Marketing and Advertising

60020 Rent

60021 Utilities

61000 SG&A (Selling, General and Administrative)

62000 Insurance

Payroll (Account #79000 – 79999)

79001 Payroll – Division #1

79002 Payroll – Division #2

79900 Payroll – Head Office

Other (Account #80000 – 99999)

80000 Gain on Sale of Assets

90000 Loss on Sale of Assets

Within the chart of accounts, the accounts are typically listed in the following order:

| Chart of Accounts: Listing Order of Accounts | |

|---|---|

| • Balance Sheet Accounts | o Assets |

| o Liabilities | |

| o Equity | |

| • Income Statement Accounts (*) | o Revenues / Income |

| o Expenses | |

| o Gains | |

| o Losses | |

| ( * Operating accounts go first, followed by non-operating. ) | |

Depending on the size and nature of a business, the chart of accounts can include a few dozen accounts – or a few thousand.

It is at the discretion of every company to tailor its chart of accounts to best suit its needs.

There are 5 main types–or elements–of accounts used in accounting, represented in the accounting equation:

Accounting Equation

Assets accounts are used to track resources controlled by a business as a result of something that happened in the past from which economic benefits (= things that make the business financially better off) are expected to flow in the future.

Examples: cash, investments, accounts receivable, inventory, supplies, land, buildings, equipment, and vehicles.

Liabilities accounts represent the amount that is owed by a business to its creditors, which will result in a payment of money at some point in the future.

Examples: accounts payable, loans and mortgages payable, accrued expenses, unearned/deferred revenue

Equity or capital accounts contain the owners’ interest in the business. It is made up of the cash or assets introduced to the business by the owner, the profits generated by the business in previous year, minus any drawings that the owners have withdrawn from the business for their personal use.

Income or Revenue accounts are used to monitor the economic benefits received by a business either in the form of cash or assets (e.g., sales revenues, rental income, interest from bank deposits).

Examples: sales of goods, service revenues, fees earned, interest income

Expenses accounts represent revenue and capital expenditure that relate to the usual day-to-day course of business (e.g., rent, utilities, interest, salaries) and long-term economic benefits respectively (e.g, purchase of a new building).

Examples: marketing & advertising expense, wages expense, insurance expense, interest expense

Most accounting systems require that every transaction will affect two or more accounts–”debit” and “credit”–called double-entry bookkeeping.

For example, a cash sale will increase both the Sales account and Cash account.

Do the terms “debit” and “credit” make you want to run away (far far away)?

Worry not, you’re not the only one.

And the good news is, the debit/credit concept is surprisingly easy to grasp.

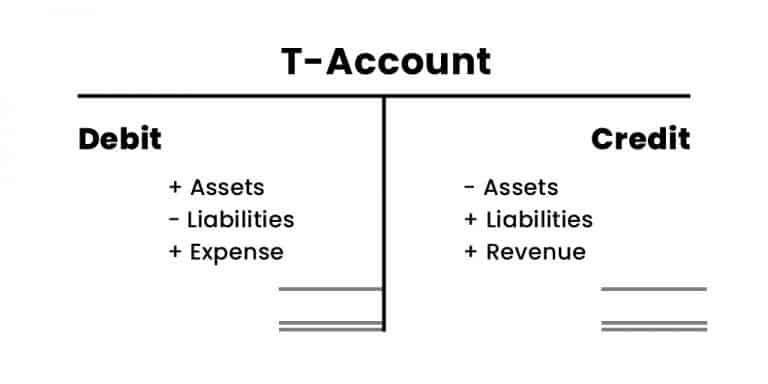

Thankfully, there is a set–and logical–way of assigning debits and credits to assets, liabilities, equity, revenues and expenses.

Depending on the account, a debit can increase or decrease the account

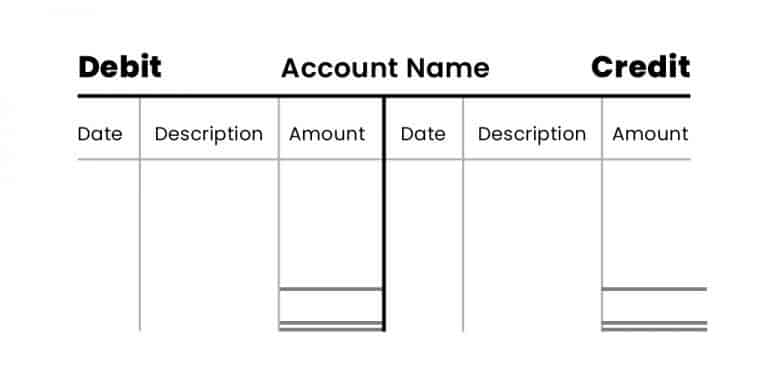

| Debit | Credit |

|---|---|

| Left side on T-account | Right side on T-account |

| Account is “debited” | Account is “credited” |

| Assets Increase - Debit | Assets Decrease - Credit |

| Liabilities Decrease – Debit | Liabilities Increase - Credit |

| Expense Increase - Debit | Revenue Increase - Credit |

| Example: Cash (= asset) increases when a business (supplier/seller) sells product/service for cash to a customer. | Example: Cash (= asset) decreases when a business (customer/buyer) buys product/service for cash from a supplier. |

It will make it even easier for you to remember debits/credits if you visualize the individual accounts within the general ledger in a shape of a letter “T”.

When a change takes place in an account, either it will be recorded on the left side or on the right side of the T-account:

There are only two main things that can happen in an account:

Increase or decrease in value.

In order to illustrate this point, just imagine your own wallet:

Either there is inflow of cash (you just got paid) or there is outflow of cash (you just bought something).

To record these two movements, every account is divided in two sides. Increase is recorded on one side and decrease is recorded on the other side.

Double-entry

Sign up for our Newsletter

Get more articles just like this straight into your mailbox.

Related Posts

Recent Posts